import numpy as np

import pandas as pd

import seaborn as sns

import yfinance as yfDANL210 Project

Stock Performance vs Ethical Performance

1 Introduction

This project will address the relationship between Environmental, Governance, and Social (ESG) risk ratings and stock performance. ESG risk ratings evaluate a company’s ethical performance and how well they manage risks and opportunities in environmental, social, and governance areas. Given this, I will be able to analyze the relationship between stock performance and ethical performance. All data was collected from Yahoo Finance.

2 Data

tickers_history = pd.read_csv("tickers-hist.csv")

esg_data = pd.read_csv("esg.csv")esg_data = esg_data.rename(columns={'0': 'total-esg', '0.1': 'enviro_risk', '0.2':'social_risk', '0.3':'gov_risk', '0.4':'controversy'})2.1 Variable Description

2.1.1 esg_data

total_esg: Total ESG rating. Environmental, social, and government risk ratings combined.

enviro_risk: Environmental risk rating.

social_risk: Social risk rating.

gov_risk: Governmental risk rating.

controversy: Controversy level.

3 Descriptive Statistics

3.1 Summary Statistics

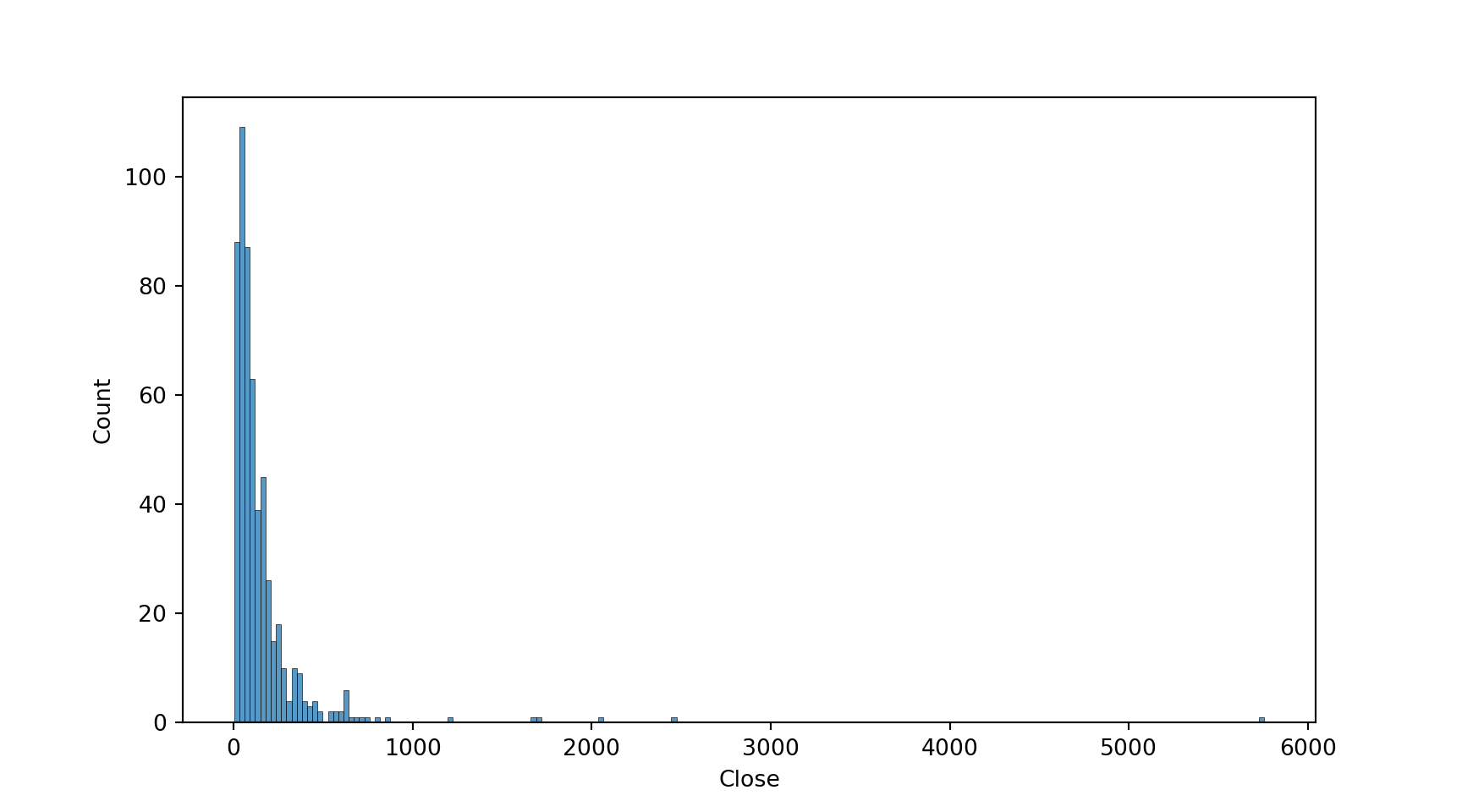

esg_data['enviro_risk'].describe()count 537.000000

mean 5.827188

std 5.301806

min 0.000000

25% 1.800000

50% 4.000000

75% 9.000000

max 27.300000

Name: enviro_risk, dtype: float64esg_data['social_risk'].describe()count 537.000000

mean 9.042644

std 3.612652

min 0.800000

25% 6.700000

50% 8.900000

75% 11.100000

max 22.500000

Name: social_risk, dtype: float64esg_data['gov_risk'].describe()count 537.000000

mean 6.811173

std 2.378037

min 2.400000

25% 5.200000

50% 6.300000

75% 7.900000

max 19.400000

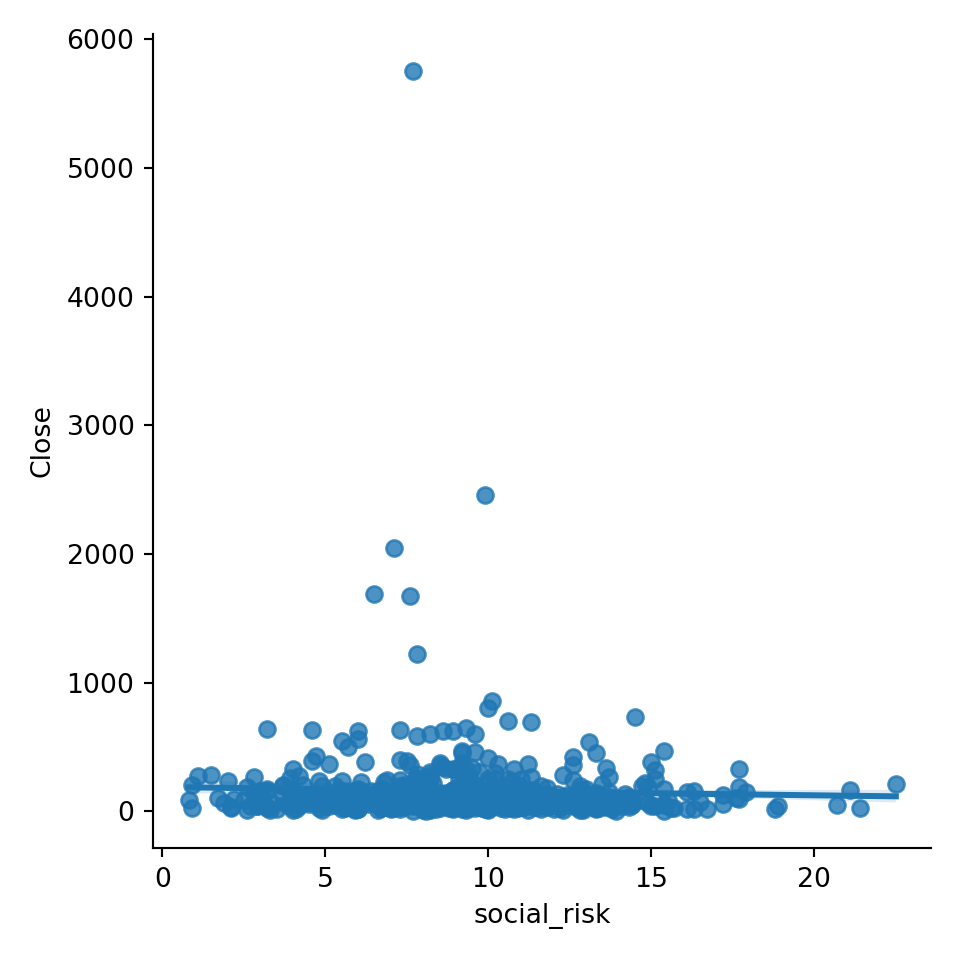

Name: gov_risk, dtype: float64tickers_history['Close'].describe()count 357202.000000

mean 142.152567

std 297.241789

min 0.980000

25% 40.449798

50% 81.209999

75% 152.080002

max 8099.959961

Name: Close, dtype: float64tickers_history['High'].describe()count 357202.000000

mean 143.808907

std 300.607248

min 1.060000

25% 40.966236

50% 82.190002

75% 153.830002

max 8158.990234

Name: High, dtype: float64tickers_history['Low'].describe()count 357202.000000

mean 140.424490

std 293.761505

min 0.780000

25% 39.901238

50% 80.220911

75% 150.270004

max 8010.000000

Name: Low, dtype: float64Merge the data frames esg_data and tickers_history in order to compare:

merged_df = pd.merge(esg_data, tickers_history, left_index = True, right_index = True, how = 'inner')Distribution of Close:

sns.histplot(merged_df['Close'])

Distribution of Environmental Risk Rating:

sns.histplot(merged_df['enviro_risk'])

4 Exploratory Data Analysis

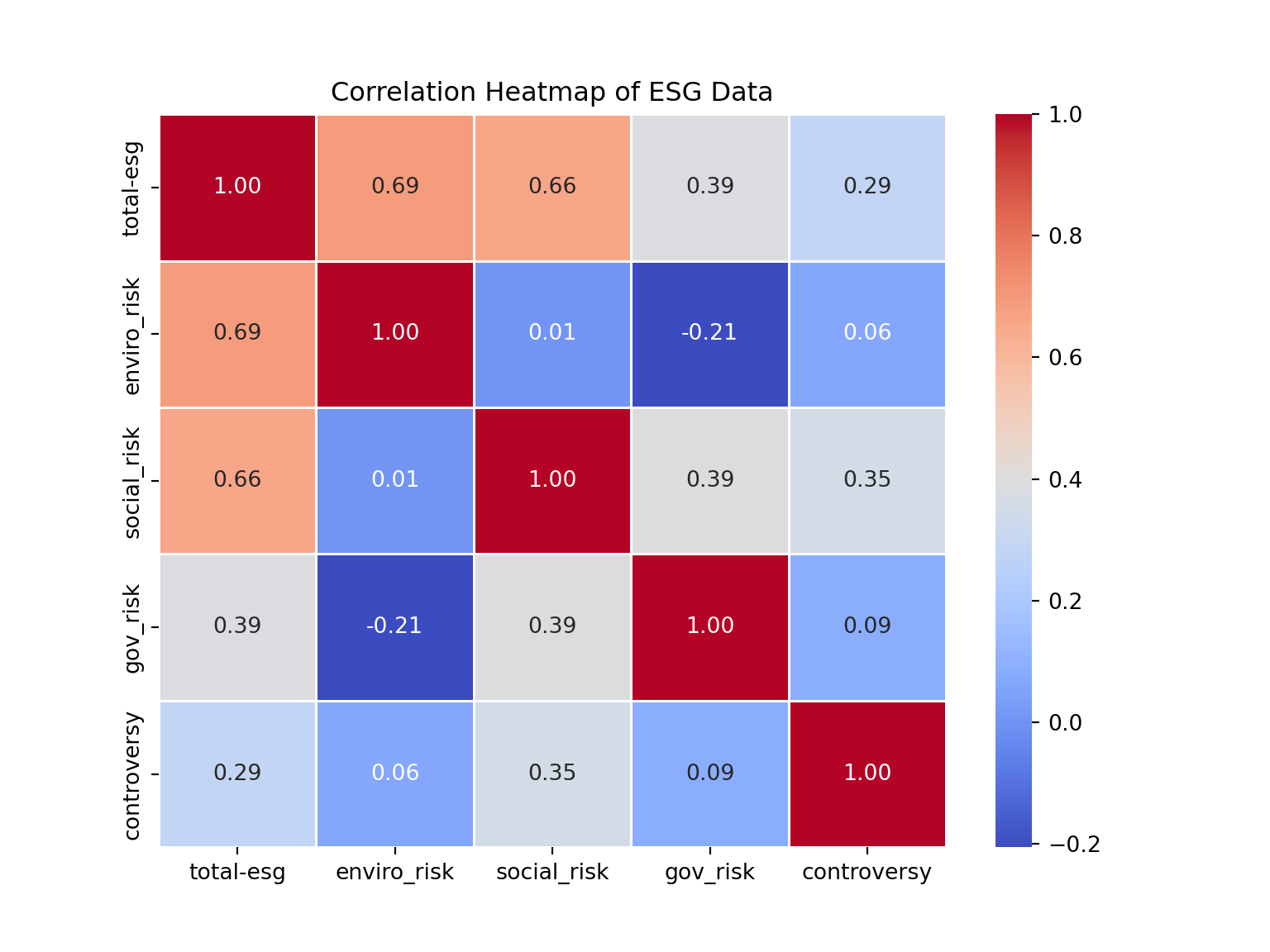

4.1 Correlation Heat Map of ESG Data:

import matplotlib.pyplot as plt

corr = esg_data.corr()

plt.figure(figsize=(8,6))

sns.heatmap(corr, annot=True, cmap='coolwarm', fmt='.2f', linewidths = .5)

plt.title('Correlation Heatmap of ESG Data')

plt.show()

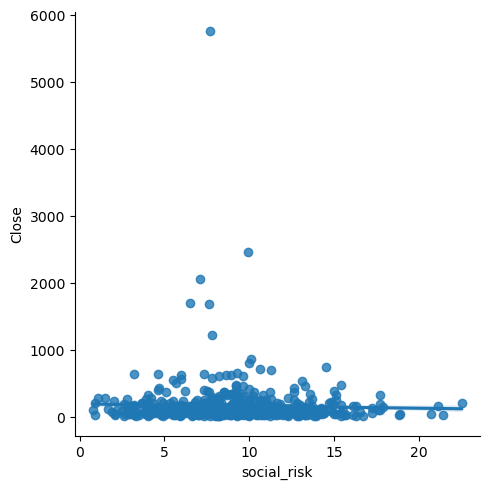

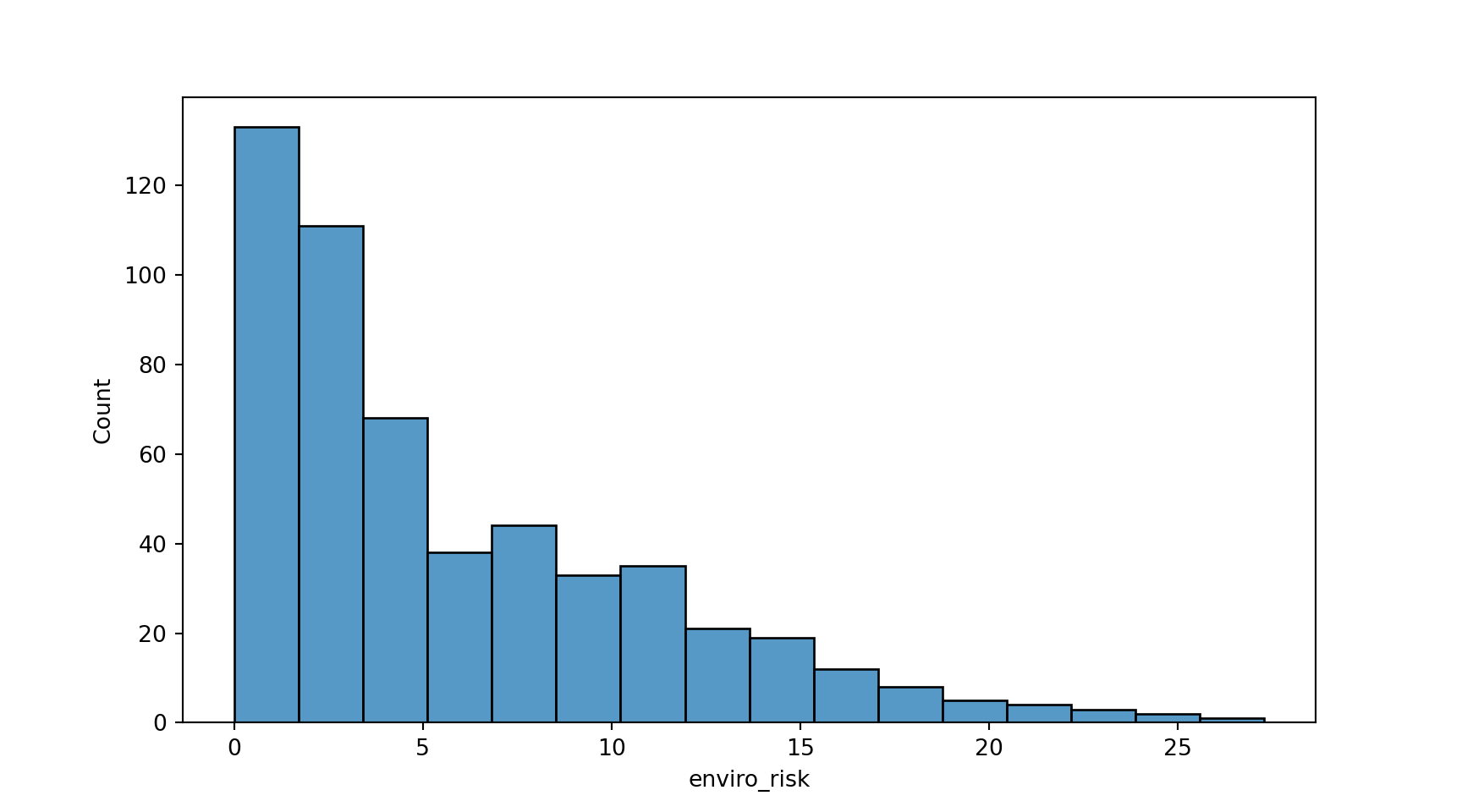

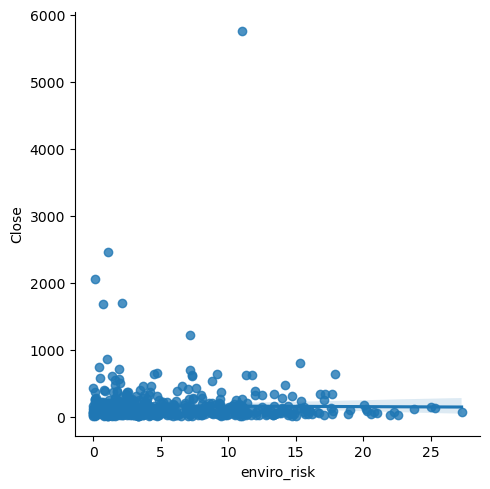

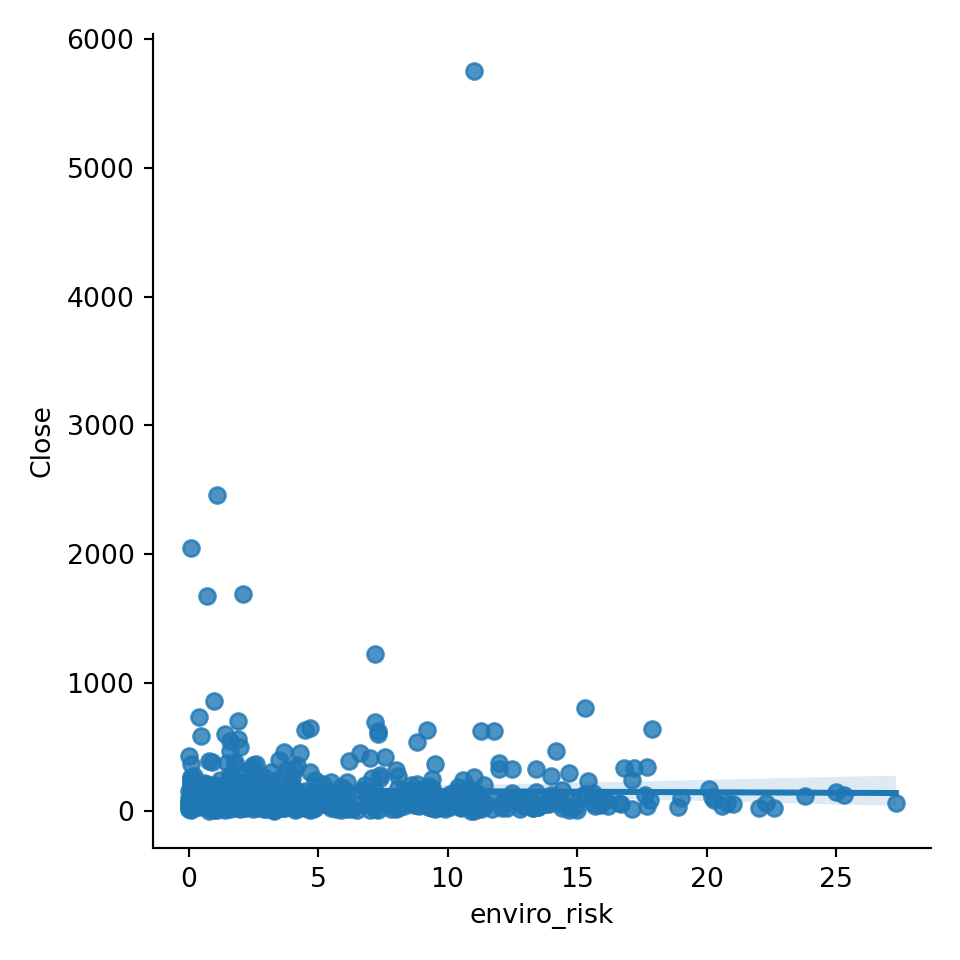

4.2 Relationship between Close Price and Environmental Risk Score:

sns.lmplot(merged_df, x = 'enviro_risk', y = 'Close')

There is not much correlation between Close Price and Environmental Risk Score. Our scatter plot and best fit line are relatively flat. If anything, there is a slight positive relationship. Higher risk might mean a higher close price, however, we cannot make a conclusion from this.

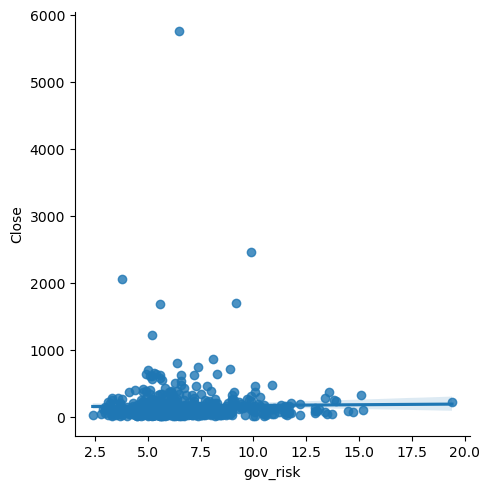

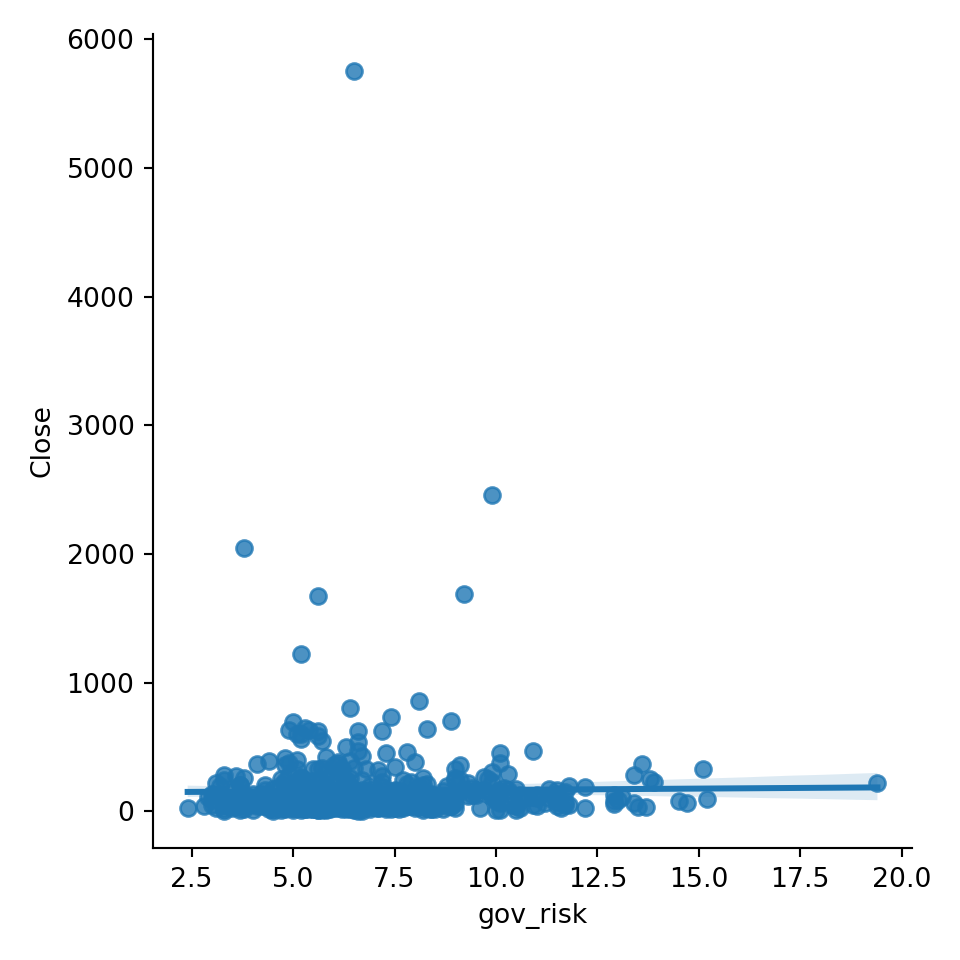

4.4 Finally, relationship between Close Price and Government Risk Score:

sns.lmplot(merged_df, x = 'gov_risk', y = 'Close')

Once again, there is not much correlation between the two. Like environmental risk, there could be a slight positive relationship. As risk increases, so does close price. However, we cannot conclude this.

5 Conclusion

There may be somewhat of a relationship between stock performance, such as a company’s Close Price, and ethical performance. However, more research is needed. A conclusion can not be reached simply from Yahoo Finance. There are also other factors besides risk ratings that affect stock performance. Examples include macroeconomic conditions, industry trends, and company financials.

6 Significance

It is important for companies to pay attention to their own ethical and stock performance and how the two interact. Companies that perform well in ESG ratings may be able to achieve long term sustainability in their business. Long term sustainability may in turn attract new investors and minimize risk. In addition, they can use ESG ratings to see how well they are handling risks and opportunities. This may give companies a competitive edge.